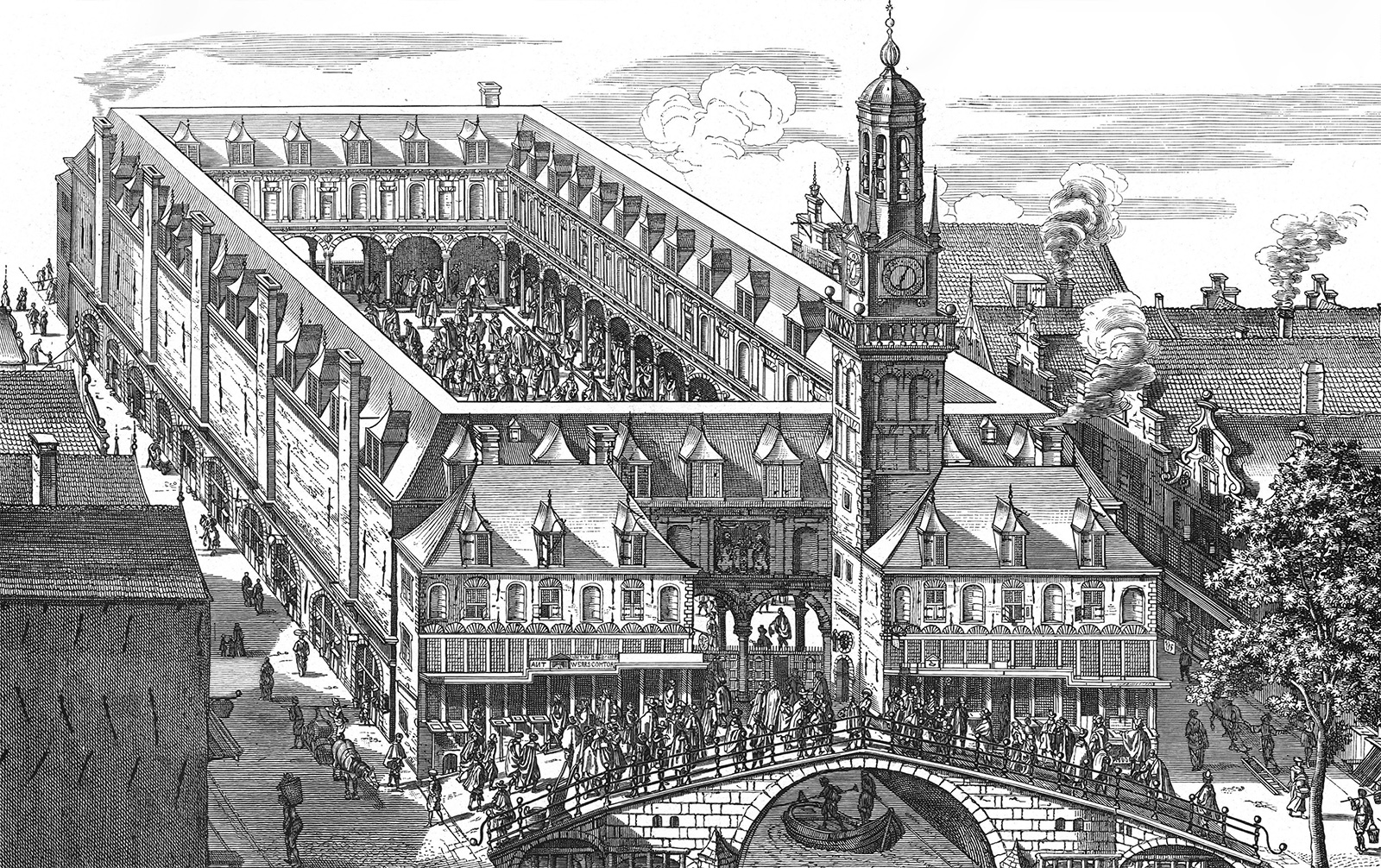

An illustration of the Amsterdam Stock Exchange, established 1602

When founders, limited partners, and investors ask us which companies exemplify Tribe’s culture, process, and decision-making towards successful outcomes, we point to three companies: Facebook, Slack, and Carta. These companies track our trajectory from operators to investors culminating in our partnership with Carta, where we’ve doubled, tripled and quadrupled down on our initial investment. This article explains why at Tribe we say, “We make N-of-1 companies.”

Our early careers were spent at Facebook and within the social web ecosystem when it was just getting started. During that time, we led the discovery of new approaches and frameworks to utilize data for informing critical decisions throughout the lifecycle of a product, from the earliest stages of growth through IPO and beyond. As we transitioned into becoming investors, we evolved our frameworks to help identify and recognize product-market fit early in the life cycles of startups.

Our frameworks led us to fund Slack and other category defining companies in the early stages of product-market fit. We have developed concepts such as “Atomic Units” and “N-of-1” to describe core ideas that aid us as partners for founders seeking to create big impactful companies.

With Carta, we are seeing the emergence of another generational company in a similar mold to Facebook and Slack. In Carta’s first act, the company has transformed from a service provider of cap table management to critical infrastructure focused on the atomic unit of equity. The company’s execution in the first act gives us conviction in the team and the coming second act.

We believe Carta will emerge as a central utility for the financial and technology industries around which large swathes of economic activity will orbit.

At Tribe, we have partnered with Carta to attack this audacious vision and create a generation defining N-of-1 company.

As longtime participants, observers and investors in technology companies, we spend a disproportionate amount of our time thinking about how large companies come into existence. Our thinking rests in part on our ability to recognize product-market fit using a variety of quantitative approaches. We’ve written about them extensively. While the approach we take to product-market fit is a keystone of our investing philosophy, it is a means to an end.

Our primary goal is to help create massive, generation-defining companies.

Amongst the Tribe team, we refer to this broader goal as trying to find “N-of-1” companies, with language that we had originally started using while working together at our prior firm. We have subsequently evolved our thinking. This concept is now the centerpiece of our philosophy at Tribe.

The phrase “N-of-1” has multiple meanings for us. It refers to companies or products that are capable of becoming much larger than what people expect early on. Their level of product-market fit is so strong that it carries the business through successive orders of magnitude of scale in ways that would have been unthinkable when they were getting started.

A nascent example was Uber in 2014, where on one side Aswath Damodaran, a finance professor at NYU, used a value-driven approach to argue that Uber was overvalued in this post. Bill Gurley made the counter-argument in this post by focusing on TAM and how markets will transform and emerge. Since going public in mid-2019 the markets have valued Uber between $40B and $78B suggesting that $17B was, in retrospect, not such a bad price. Looking back, Uber laid the foundation for a network of “gig workers,” and satellite markets continue to materialize around that concept. This example emphasizes how thinking about the status quo misses the point and fails to capture how N-of-1 companies terraform new markets and possibilities. Recognizing what is possible and why those possibilities orient around the N-of-1 company is key to understanding the opportunity before it is too late.

In the largest cases — Facebook, Google, and Amazon — network effects have emerged as a primary phenomena that amplify product-market fit across multiple stages of scale. While we do not believe that explicit network effects are necessarily the only way to create huge outcomes (e.g., Intuit) they are clearly quite helpful. Network effects have remained key to the paradigm of creating huge outcomes so far in the 21st century. These companies are not merely “1-of-N” similar companies but are rather companies that stand alone in their respective sectors as “N-of-1”.

What does it take to make an N-of-1 outcome?

N-of-1 opportunities are incredibly rare.

Even with our combined history we have only witnessed a handful of such opportunities across many years of operating and investing. N-of-1 companies are often well known but it is the scope and potential scale of these opportunities that are misunderstood even when they are already sizable businesses.

The adage “past performance is not indicative of future results” couldn’t be more true in these cases. These companies break pre-existing frameworks for determining what success could look like in their respective sectors. By definition, they are difficult to understand and harder still to identify.

Through our experiences and observations, we have identified three key ingredients that need to exist in order to propel a company from merely being successful to potentially becoming a N-of-1 company.

- Emergence of a new atomic unit of value — Every era has a raw “resource” (oil, idle cars/gig workers, friend graph, etc.) that when captured, catalyzes an immense wave of innovation within a sector. These are obvious and highly contested in hindsight but are largely non-obvious to incumbents at the time of discovery. Commentators often dismiss the initial market as “too small”. N-of-1 companies recognize this reorientation early and effectively build technology products that take advantage of external macro trends to capture an early foothold in acquiring the newly discovered unit of value.

- Capture of this atomic unit of value — N-of-1 companies are able to translate their early foothold into a dominant position to acquire the newly viable atomic unit as fast as possible. Dominance over the atomic unit enables these companies to build category-defining businesses around the resource thus cementing their position for the long term. As a result, incumbents and newcomers quickly face uncrossable moats in their attempts to compete with the N-of-1 firm.

- Transformation into a central utility — With dominance and control of the atomic unit, N-of-1 companies are able to rapidly extend their family of products. Once these companies create scarcity of the atomic unit, adjacent economic activity refactors around the companies leading to broader market disruption. An ecosystem starts to emerge because other companies of different types start to rely on each N-of-1 company for their own survival. The N-of-1 companies become immovable central fixtures — utilities. In doing so, N-of-1 companies transform from merely services to central utilities that power entire ecosystems.

Let’s investigate one of the largest historical examples with this framework in mind

In the early days of the consumer web circa-2004, the dominant unit of value was pageviews.

Pageviews were known to be an unreliable metric but, nonetheless, the metric was widely used by existing websites, social networks, and advertisers. While the majority of the market was focused on pageviews, Facebook was building and concentrating on their social graph.

The recasting of social networks in terms of a graph with edges and nodes would have seemed abstruse to other companies of that era. Existing social identities and graphs on the early web were either distributed (email) or fragmented and niche (e.g., ICQ, Yahoo groups, web forums,) carrying with them little immediately extractable value outside of being a target for spam.

Pageviews meant CPMs which meant revenue, and that was the future.

Yet Facebook took the contrarian view, architecting both their technology and product philosophy around growing the underlying networked graph of users and friend edges between them. Their timing was just barely right. The adoption of the Internet for young people was growing very quickly in the early 2000s and a cohort of young people was simultaneously experiencing a massive increase in Internet usage. All of this was happening during the cohort’s early college years, a notoriously significant time for the creation of life-long social identity and bonds. This mix of external factors was just right for Facebook and they managed to take advantage of it.

Pageviews remained the dominant unit of value in the public through the mid-2000s. The market’s view on valuation reflected this thinking (see here for example). In that era, the market didn’t appreciate that economic activity was refactoring itself around Facebook. They instead focused on the fact that Facebook was not yet dominant in regards to pageviews and revenue in the late 2000s.

To take just one data point, at the time Facebook was only a small contributor of referral traffic to major news outlets. However, some basic modeling showed that if trends were to continue Facebook would eventually be in the position to completely dominate the entire news ecosystem. As it was playing out in the news ecosystem, similar things were occurring in mobile app development, sports, and also the broader advertising ecosystem.

Today, economic activity has concentrated around Facebook to such a high degree that it is taken as a given that Facebook effectively excises “tax” on a large swath of companies that depend on the platform to survive and succeed. As such they have transitioned from merely a social network to a true utility around which orbits a vast amount of economic activity.

Facebook of the late 2000s had all the ingredients in our framework to become an N-of-1 company and the last decade has demonstrated that ascension.

This sounds obvious in retrospect but it was far from obvious in 2009 when they were being valued at $10B with a couple of hundred million users, making only a fraction of the revenue of MySpace and with a very unfavorable macro environment only a few months after the collapse of Lehman Brothers. People thought Facebook was overvalued back then but they underestimated the scope and scale that would become available and addressable to Facebook as they achieved dominance over their atomic unit of value.

Carta, an N-of-1 catalyst and emerging utility

For many of us at Tribe, our first exposure to Carta was as users through our investment and advisory activities throughout 2013 and 2014.

Called eShares at the time, the ability to simply view equity holdings in early stage companies in a structured, standardized manner was an elegant step up from “lawyers with spreadsheets”. It was a great product, but the market seemed small and niche. It wasn’t until we had a formal look at Carta in 2016, just after their series B, that we started to understand the true scope and scale of the opportunity that Carta was uncovering. At the surface, their primary product was still cap table management. Carta’s 409a business unit had just started. Pricing was crude, and synergy between their products was non-existent. But Henry had a vision, articulated rather elegantly in his Series A pitch in this slide.

The insight is simple. Carta’s cap table and 409a businesses were merely a wedge to get at something larger. What they were really doing was accumulating the underlying atomic unit by becoming the system-of-record for asset ownership. The dominance of that system-of-record would enable Carta’s entry into a much wider scope of businesses and a much larger scale of opportunity. The traditional assessment framework of a business such as early eShares was to look at it in isolation comparing the business to companies such as Solium and concluding that the TAM was roughly $1B in revenue. We were at Social Capital at the time and took a contrarian view along with Menlo Ventures, ultimately co-leading the Series C at a $320M post-money valuation.

Through every subsequent round, the story has effectively repeated itself with sentiment divided starkly into two camps.

On one side are those that acknowledge Carta’s previous success at each milestone but consider the potential of their existing and future businesses in isolation. On the other side are those that see the businesses as simple interfaces that could reach immense scale as they benefit from the underlying system of record.

In late 2018, Carta was raising their Series D with the goal of building out investor services. At the time there was skepticism about Carta’s ability to service LLCs, venture funds, hedge funds, and PE firms. Fast forward a mere 24 months after raising their Series D at $800M post, and Carta has now built the fastest growing fund admin business in history. In mid 2019, Carta was raising their Series E with the goal of scaling the cap table and fund admin businesses while laying the groundwork for the exchange business. Eight months after raising the Series E at $1.7B post, we now have even more conviction that we have only witnessed the beginning of Carta’s journey.

How is this possible and where does this lead?

Equity is the atomic unit powering the entire stack of entrepreneurship

While equity and entrepreneurship are not new per-se, widespread equity among employees along with the ability for businesses to reach extreme scale on short timeframes is fairly recent.

Widespread distribution of Restricted Stock Units beyond senior executives began in the early 2000s (reference). The importance of this practice becoming widely adopted cannot be overstated. Prior to this, extremely high-skilled individuals creating value that could be scaled globally with technology did not have a way of benefiting commensurately from their ingenuity and impact. Without equity, it’s not possible to align incentives in a way that is attractive to highly skilled employees relative to other employment. Widely-owned equity is the mechanism by which entrepreneurship spreads from just the founder to the entire team of employees who devote substantial portions of their working life towards building something whose rewards they can take part in.

It is the contribution of those skills across the employee base of all venture backed startups which enables them to create the enormous economic impact that has occurred in the past 20-30 years. Pre-modern entrepreneurship involved only the founder whereas modern entrepreneurship brings large swathes of employees into the fold.

The rise of venture capital as an asset class was a critical component behind this innovation. Early venture capital involved investors buying very large fractions of early stage companies at remarkably low valuations by today’s standards. This early ecosystem featured Marx at his best with Capital flexing itself in an adversarial nature against Labor, with founders retaining some ownership and leaving employees with a pittance. The evolution of venture capital in the past 30 years has seen the emergence of a significantly more aligned model of venture capital with investors seeking to become partners of the company rather than merely owners.

It is within this sweep of history that equity has gone from merely indicating ownership by Capital to become the core tool to incentivize and mobilize highly skilled talent to embark on audacious projects. The recognition of the subtly evolving role of equity leads us to recognize equity itself as the atomic unit of value that fuels modern entrepreneurship.

When viewed through the macro lens, it is well known that the growth in value which has been created in tech companies since the great financial crisis has been almost entirely in the private markets. This trend has two well documented underlying forces.

On the company side, being public is more onerous and daunting than at any point in history with the combination of ever expanding regulations and ever more diffuse objectives being pursued by the broad public markets. Staying private is often a better model of ownership for company building as it allows management and owners to be committed and aligned towards building and investing for the long term.

On the capital side, large scale investors have witnessed the incredible speed and scale of value creation that occurred with the tech behemoths since the dotcom bust and they are ever more willing to invest in these late-stage, pre-IPO firms, trading liquidity for large, asymmetric potential investment gains.

Today, widespread employee equity ownership is a necessary but insufficient catalyst for the kind of value creation entrepreneurial firms have seen in the past few years. Employees need some way to actually realize the value of their equity, creating a requirement for liquidity. In the early 2000’s, liquidity typically came in the form of an IPO within five years. This worked well in some cases but in recent times long liquidity horizons have generated employee fatigue and limited employee mobility. This trend has made it harder for entrepreneurial firms to hire highly-skilled, highly-mobile talent when pitted against the largest technology players. Early liquidity would provide a release valve, but the legacy ecosystem provides few options and those few that exist are bespoke and expensive.

This is the challenge and opportunity of our era. As companies stay private longer, the continued stress on liquidity translates to continued stress on modern entrepreneurship. Incentives surrounding equity have become perverse, with employees and shareholders beholden to a timeline so indeterminate that it begins to break the notion of incentive alignment that was originally achieved with widely owned equity.

This is Carta’s insight:

the achievement of a dominant system-of-record for this atomic unit of equity has the potential to unlock liquidity in the private markets and thus catalyze global growth and innovation for the next 20-30 years.

In the process of doing so, Carta evolves from merely a service into a core utility powering all of entrepreneurship.

Carta has completely dominated the capture of this atomic unit

The existing ecosystem is ill-equipped to address the challenges facing modern entrepreneurship.

While Carta’s vision early on entailed the creation of the dominant system-of-record, it was by no means a foregone conclusion that they would be able to achieve this milestone on the path to an N-of-1 outcome. The path to achieving that dominance rested on developing a product strategy that would achieve a very high level of product-market fit within reasonable constraints of capital and time investment.

The strategy that emerged involved the interplay between cap tables, 409a and investor services.

By creating just the right on-ramps into the product at critical times in the equity management lifecycle, Carta was able to gain a strong foothold in the cap table management business. All companies need 409a services regularly and Carta found a way to offer that service in conjunction with a sales motion that could upsell into cap table management and vice-versa.

The interaction between cap table services and 409a services described above created a pattern of product-market fit that was quite strong and recognizable to a trained observer as a sustainable and healthy dynamic. The next step was in recognizing and amplifying a network effect that was emerging between companies and investors.

In roughly 2016 we started hearing about investors including a clause in term sheets to startups requiring them to use Carta for cap table management. This suggests a network effect between investors and founders by which increasing network scale and density drives ever lower barriers to adoption for the incremental node in the network. To capitalize and amplify this pattern, Carta introduced the investor services line of business. This set of products enables funds to completely administer the back office aspects of fund management through Carta.

The network effect is effectively articulated in this diagram which shows the interaction between companies, investors and underlying employees as the graph of ownership grows.

Carta launched the fund administration business in 2017 and adoption has exploded out the gate. It is currently growing at 2.7x year over year with negligible churn.

Carta’s fund administration business has become the fastest growing fund administration business in history.

Without Carta’s central registry and associated participants, this would have been difficult if not impossible to accomplish. However, the strength of the underlying system of record shows itself very clearly in the go-to-market strategy for fund admin. Consider the sales motion for fund admin. The vast majority of fund admin leads involve funds whose underlying portfolio company equity is already managed by Carta. For some explicit evidence, investors with 11-50 portfolio companies on Carta are 21x more likely to pay for Fund Admin as investors with 2-10 portfolio companies on Carta.

If we extrapolate this pattern of growth over the next few years as Carta’s system of record grows to capture all US backed venture along with a significant portion of LLCs and other pass through entities, we see that a future fund administrator will be faced with a clear choice: Use Carta for fund administration and have instant look-through into their portfolio company equity positions, or use some other administrator and forego this instant integration.

To give a sense of the scale of dominance that has been achieved, by our estimate, Carta holds the ownership graph of 35% of all venture backed businesses. Framed as equity value, they have over $1 trillion USD in total equity value managed on their platform today.

No company, bank, service provider or government entity in the world apart from Carta can claim this level of visibility into venture backed companies.

Some believe Carta has saturated their market. We believe that the opposite is true; Carta has realized merely a fraction of its potential.

As Carta took share in the cap table management segment, they simultaneously built the necessary foundation required to become the critical infrastructure for the atomic unit of value. To give a sense of the density of this foundation, in the span of the past four years since 2016, the average number of securities managed by institutional VCs on Carta has grown from 10 to nearly 25 today. The network is becoming denser, and therefore more valuable, presenting ever more available and achievable adjacent opportunities. By any measure, this is historically unprecedented.

The concentration of equity in Carta’s centralized registry has already attracted a large ecosystem of participants, and with it a unique competitive advantage.

There are over 15,000 companies on Carta, and 1M stakeholders (entities that own equity on Carta) interconnected with the $1T USD in equity on the platform. Every investor, company and employee brings more entrenched participants in, more equity, and more opportunities for Carta to extend its reach across a family of products.

The network effect that is driving Carta is very formidable and it’s worth noting how difficult it would be to compete with Carta at this point. As Carta launches new business lines, each one is designed to continue adding value to the core central registry and as that registry grows and solidifies it becomes ever harder to assail. In the pre-Carta era, a founder would choose from a variety of potential service providers for cap table management. In the Carta era, there is a network of investors that drives the decision towards the obvious choice. Similar effects are starting to show themselves on the investor services side. Carta has turned the decision of service providers from a series of isolated decisions into a single decision strongly influenced by the network and has thus heavily tilted the scales in their favor for all future decision makers.

For these reasons, at this point, we believe it is nearly impossible for Carta’s central registry of ownership to be replicated, and thus their position in cap table management, fund administration, and by extension future opportunities that emerge as a product of the central registry to be assailed.

The stage is set for Carta to evolve into a core utility powering the next generation of modern entrepreneurship

Recall our previous insight:

The achievement of a dominant system-of-record for this atomic unit of equity has the potential to unlock liquidity in the private markets and thus catalyze global growth and innovation for the next 20-30 years.

We believe Carta is the first company to have achieved the concentration necessary to successfully tackle this opportunity.

In the next 12 months or so Carta aims to launch CartaX, the first issuer sanctioned platform for the buying and selling of private company shares at scale. As we established earlier, there is a dire need to offer regular liquidity in the private markets to propel entrepreneurship. To put a number on the gap in liquidity that has emerged as companies stay private longer, consider the following.

About 2x as much primary capital is raised in private markets than in public markets. However trading volumes are fully 330x higher in the public markets, demonstrating an enormous gap in liquidity between the private and public markets.

This imbalance is reasonably well known and secondary stock transactions have a long history in tech involving an entire ecosystem of legacy players going back to the 90s including companies like Tradepoint and Second Market (now Nasdaq Private Markets) along with a whole swath of bankers and private brokers who manage bilateral transactions and company sponsored tender offers.

This gap continues to exist because these attempts have largely failed. They failed because they did not give founders and existing investors the level of visibility and control that they view as essential for their ownership and governance needs.

This is a product of the complexity of secondary transactions. Existing shares have an entire raft of complex terms including ROFRs, transfer agreements, and restrictions on downstream ownership entities amongst others. As a result, every secondary transaction is a bespoke, costly and resource-intensive challenge typically reserved for special cases such as founders or key execs. Companies often have very little control over these transactions, broker dealers often solicit employees without the company’s permission, transparency is disincentivized, and the majority of employees and investors miss out. Liquidity remains elusive. While these transactions do serve a niche purpose, they are a huge headache for everyone in their current incarnation.

That said, the network of bankers and brokers exists for a reason — they transmit trust and identity between the buy and sell sides.

This is where Carta’s dominance of the atomic unit of equity shines. With full knowledge of every single share, investor and all legal stipulations surrounding the equity and company, CartaX will be the first secondary platform to confer that trust through technology, and do so at scale.

Auctions become a predictable turn-key event, with two major features that were previously nearly impossible to implement. Firstly, auctions can be, for the first time, fully issuer-sanctioned. The issuer (i.e. company) can exercise controls on the auction configuration, ensuring that the issuer’s interests remain intact. Secondly, upon the issuer’s election, the auctions can be accessible by any institutional investor on the buy side and anyone on the cap table on the sell side. This was previously theoretically possible but infeasible due to no single entity being able to contact all possible parties in any reasonable fashion.

In this new world, private companies can effortlessly run controlled auctions as frequently as they choose, giving them a much needed lever to keep incentives aligned with all their shareholders, while maintaining the benefits of remaining private.

We believe this is a game changer for the companies that use it and the people surrounding those companies.

For companies it gives their equity extra implicit value with which they can better attract, incentivize and retain both talent and capital. For investors it gives a new broader path to access the returns available in the private markets. Carta has already begun supporting this capability through it’s existing transfer capabilities supporting >$1B in notional tender volume growing 1.9x year over year as of early 2020. We view this signal as an early indicator of product-market fit for CartaX and it appears far stronger than that of incumbents in the space.

We expect the resulting behavioral shift across startups to be substantial when CartaX launches widely.

To prepare ourselves at Tribe, we’ve invested heavily for the last year in research that explores how this affects our capital allocation strategies, and how to best position our portfolio companies to leverage CartaX in their own operations. We expect the greater venture ecosystem to follow as a gradient of liquidity becomes the norm in the private markets and CartaX becomes a critical component for any startup’s success.

This opportunity represents the start of the next chapter for Carta. Already considered critical for venture backed private companies and funds, with the introduction of CartaX, Carta will capture the full equity management stack, spanning from issuance at the earliest stages to generating liquidity at later stages. Furthermore, Carta has developed a proven playbook and network that could be leveraged to deploy this into any asset market.

This provides a line of sight to all privately held asset classes and surrounding participants.

Carta is already expanding into these adjacent markets, and in a conservative interpretation of their market, Carta has the potential to serve as a core utility and source of liquidity for the entire fractionally owned private asset ecosystem including the venture, buyout and REIT markets, both domestically and internationally in liquidity locked regions. Those three markets represent over $2T of annual investment flows.

It should be noted that this revenue opportunity isn’t merely addressable but is likely serviceable. The dynamics of growth and product-market fit for Carta are such that in the next few years they have a good chance of being the sole system of record for ownership of all private assets. It is the first example we have seen of a B2B fintech company that exhibits true network effects and has all the hallmarks of being an N-of-1 company.

This logic leads us to the belief that the revenue opportunity from the current state isn’t 2-3x but rather is at least 10x if not 20-50x.

More importantly, as believers in entrepreneurship, we’re passionate about working with Carta to usher in the next chapter of modern entrepreneurship through empowering incentive alignment and liquidity for private markets across the world.

While we can’t possibly fathom the full extent of the impact this shift will have, we believe it is inevitable, and we are proud to be standing by Carta’s side as the future unfolds.

— The Tribe Capital team

To learn more about Carta, N-of-1 and atomic units, please view our FAQ.

We’re a venture capital firm focused on recognizing and amplifying early stage product-market fit. Reach us at hello@tribecap.co.